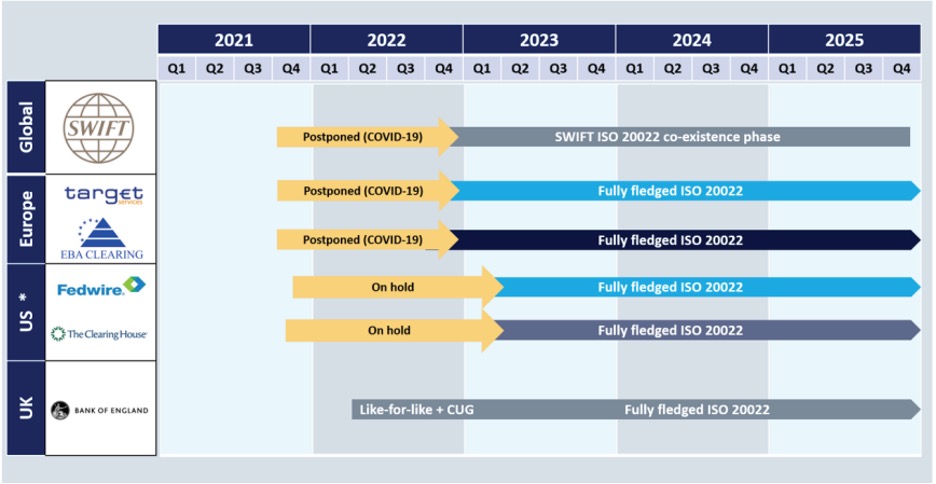

On July 5, 2018, an announcement was published by the Federal Reserve Board, which described the intent to adopt and migrate to the new ISO 20022 standard to replace the existing financial transaction messaging service. In response, last year SWIFT also announced a planned, formal migration to ISO 20022 MX, an established global messaging system that is emerging as the established standard for virtual payment messaging and processing transactions in a simplified and standardized manner. The US Federal Reserve Bank has already indicated that its new FedNOW payment system and FedWire Funds Service will be based on the ISO 20022, expecting to be fully transitioned by November 2023, to stay in step along with 70+ other participating countries. It is expected that the ISO 20022 standard will navigate 87% of worldwide transactions in value within the next 5 years. Some perks to making the move to ISO 20022 MX is the ability to request Real-Time Payments, operate outside of business hours, and improve security, while minimizing delays in transaction processing.

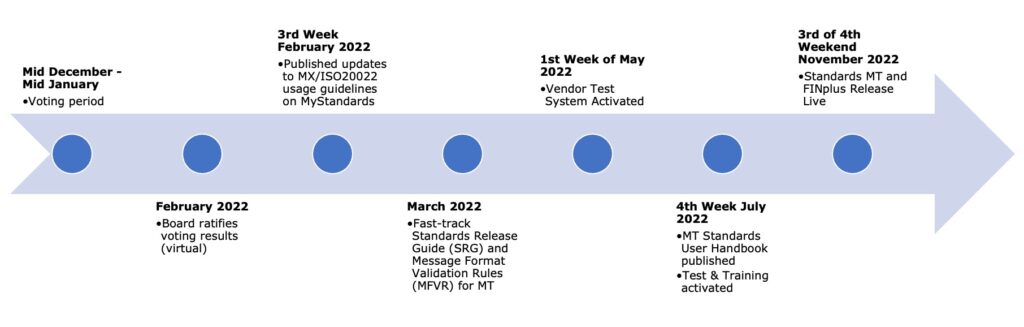

SWIFT’s quickly-approaching commencement date is June 2022 and the complete migration is anticipated to roll out over a 3-year period, during which the MT standard will remain active in tandem with ISO 20022 through Q3 of 2025 to inspire a smooth transition. As SWIFT makes a move to begin the transition from the previous MT standard to the ISO 20022MX system for global cross-border payments, there are imminent milestones that are on the horizon. All financial institutions (FIs) should keep these changes on their radar to prepare accordingly their internal governance, technology, and processes to avoid the risk of being excluded from the international payments system and access to central banks. It’s recommended that FIs have an assessment performed of their financial framework in order to anticipate any updates needed to welcome the ISO 20022 standard. On March 31, 2022, SWIFT released the following timeline guidance, mandating that all banks currently on the SWIFT network have the ability to process and receive transactions using MX messages, or ISO 20022, starting in November 2022.

While the official migration date is slated for Q4 of 2023, several benefits can already be realized within the improved SWIFT network.

- Launched in July of 2021, SWIFTGo significantly improves the experience for consumers and small businesses sending fast affordable low-value cross-border payments.

- Payment Pre-validation provides a smoother payment process with fewer hassles and eliminates inaccurate payee information, which remains one of the leading causes of international payment delay or stop-processing.

- In November 2021, SWIFT launched a new “in-flow” translation service that is positioned to ease the migration and improve results to end customers through an improved rich data collection standard. This is integral in allowing the industry to keep its existing systems running seamlessly and enables financial institutions to create their own transition timeline through the sunset date of November 2025.